How can I decide if refinance is right for me?

Your home may be the largest asset you have. Before deciding to refinance, be sure to consider the following so you can make an informed decision.

Determine your estimated costs

When you refinance, you may pay:

- An origination charge, which may include fees such as application or processing.

- Discount points to lower your interest rate further. (May be tax deductible. Consult your tax advisor regarding deductibility).

- A prepayment penalty if your current loan has a penalty for early payoff.

- Other settlement charges such as appraisal, credit report, title search, and title insurance fees.

If you’re an existing Wells Fargo Home Mortgage customer, you may be eligible for a streamlined refinance with no closing costs, application, or appraisal fees.1

Tip

You may be eligible for a reduced reissue or refinance rate on your title insurance if the property’s current policy was issued recently. Ask your title or closing agent if you qualify.

Assess how much longer you’ll stay in the home

If you plan on owning the home for an extended period of time, and the interest rates are 1/2% to 5/8% lower than your current rate, refinancing may be the right choice for you.

If you plan on owning the home for an extended period of time, and the interest rates are 1/2% to 5/8% lower than your current rate, refinancing may be the right choice for you.

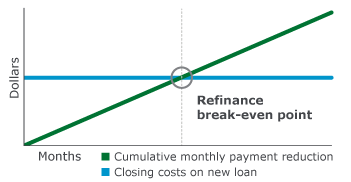

Your break-even point occurs when your savings from your new loan equals the cost of getting the new loan.

Determine your breake point

Your break-even point occurs when your

savings from your new loan equals the

cost of getting the new loan

savings from your new loan equals the

cost of getting the new loan